As we grow older our plans and circumstances change. So do our commitments. We may buy a house, begin a family or want to save more for a better retirement. Our research highlights three core stages in the average person’s commitment cycle, with transition phases in between.

The Commitment Sleepwalkers

Those in the age range of 18-24 are most likely to be Commitment Sleepwalkers. These people have an average of five monthly financial commitments, each relatively minimal. As they accrue only small commitments, they can often overlook the cumulative effect of costs. However, the longest relationship they have ever had has been with a financial commitment.

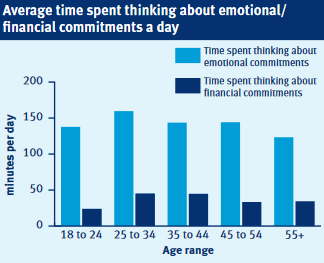

This group is the least financially committed, spending on average only £458 a month on the regular commitments we investigated. They are more likely to be living with parents or still in education, just about to embark upon their financial life. This group is the most emotionally committed, to their friends and parents in particular, spending one hour 11 minutes a day thinking about them – this is 20 minutes a day more than the average person. This trend of relative financial freedom does not last long, however, as they start to head towards greater commitment and their commitment peak.

The Fully Committed

Aged between 35-44, this group is at the peak of their financial and emotional commitments. They are likely to be paying a mortgage, looking after a child and paying off debt accrued in earlier life. They spend an average of £1,160 each month on more than 11 regular financial commitments. This is £246 more each month than the average person.

As a result of this high level of commitment, this group spends more time thinking about their regular financial commitments (45 minutes) than any other group. They are thinking about their emotional commitments for the two hours and 24 minutes a day. This is above the average but less than when they were 25-34 years of age.

It is 35-44 year old men who are the most financially committed of all – they spend an average of £1,208 each month on their financial commitments.

The Commitment Slowdowns

Those aged 55 and over have survived the rigours of being fully committed and their financial commitments are now decreasing. Over 55s spend an average £818 a month on regular financial commitments, almost £100 less than the average person and £342 less than the Fully Committed life stage. But they still spend more than the 18-24 life stage.

Over 55s also spend less time thinking about these financial commitments than other life stages – on average 34 minutes a day, which is 10 minutes a day less than the Fully Committed stage. Conversely, the time they spend considering their partner increases at this point in life to 53 minutes a day compared to only 48 minutes during the Fully Committed life stage. Relatively speaking, it appears to be a more relaxed period financially.