Your Commitments, Your Future was developed to better understand how commitments change with life stage. We define a commitment as a state of being bound emotionally or financially to a course of action or to another person or persons – ultimately to achieve a goal. We have categorised commitment in two ways; financial commitments, which describes those where a regular transfer of money is paid to an organisation and emotional commitments, those made to loved ones, family, friends, partners or pets.

There is a stark contrast in how we treat these two types of commitments. The average person in the UK is committed to spending £914 each a month on the regular financial commitments we investigated, yet only spends 37 minutes a day giving these any thought. In contrast, we spend just £87 on emotional commitments such as our partners and our children, but over two hours a day thinking about them. The average person thinks about their partner for over 50 minutes a day and their friends 25 minutes a day. But the average pension contribution of £137 a month is thought about for just three minutes a day.

It is apparent that people recognise the need to reassess their attitude to financial commitments. A quarter of UK adults (23%) believe that their finances would benefit if treated with the same care and attention as they treat their personal relationships. This is a clear message to start re-evaluating how we view our financial commitments and a call to action to start thinking of our finances as an extension of our emotional relationships.

When we delve into the attitude towards financial commitments, three in five people (59%) liken their paid-for TV payments, such as a satellite television contract, to a relationship with a husband or wife. The average person paying for paid-for TV payments spends £39 a month on satellite television and has had this commitment for an average of over eight years. Mobile phones are held in similar regard, with the average person with a mobile spending £20 a month, having held a contract for an average of seven years. The average person spends two minutes thinking about their mobile phone and three minutes thinking about satellite television. In total, five minutes a day thinking about two long term financial commitments that cost £708 a year.

It’s striking how often we commit to financial relationships but pay minimal attention to them. The lack of attention can result in us ‘sleep walking’ into long term financial relationships. For example, a third (36%) of people who are paying magazine subscriptions have had a monthly subscription for more than five years – meaning they have spent at least £433 on magazines alone. Recognising the cumulative costs of these commitments is paramount. If, for example, the average 20 year old chose not to take up a monthly satellite television and magazine subscription and instead invested £50 into a pension each month, they could accrue a pension fund of £250,356 by the age of 68, which is equivalent to £76,526 in today’s money terms2.

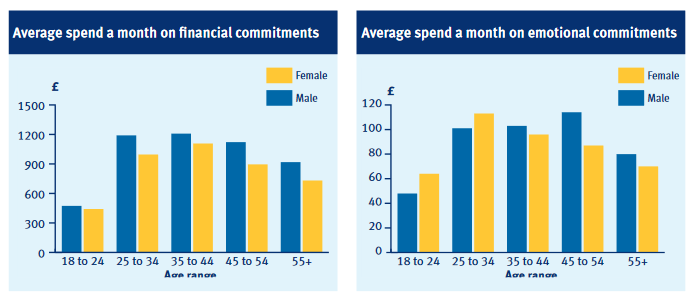

The amount spent on financial commitments varies according to gender. Our research found that men spend an average of £160 more than women on the most common regular financial commitments each month, spending £997 compared to £837. Despite this, both genders spend an equal amount of time thinking about their financial commitments (37 and 36 minutes respectively). But men consider their emotional commitments far less than women, thinking about family and friends for an average of just under two hours a day – that’s over half an hour less than the average woman.